Something that fascinates me is how people inform themselves–how they get their news, what books they read, who they listen to, and what they watch. This was the topic of one of my first blog posts, “You Are What You Read.” I think that people are profoundly influenced by who they listen to and what they read.

Sometimes people ask me what I read, and some just assume what I read by what I write. I read a lot. I believe that “leaders read and readers lead.” Here’s how and what I read.

How I read

Much of my news intake happens through my email. If I find a site that has a good articles on it, I’ll subscribe to their email newsletter or RSS feed. Side note: if you are a blogger, the surest way to lose readers is to not have a way for people to subscribe to your posts. If I go to a site, and they don’t have a way to subscribe (either through my RSS reader, or by email), it’s unlikely that I’m coming back.

If I subscribe to a new newsletter via email, I will let the newsletters come to my Inbox for a few weeks, and I’ll read most of them. After a few weeks, I decide whether the newsletters are worth my time to continue reading, and if it is, I create a filter in Gmail for them. I prioritize them by putting them into one of three categories:

High Priority: these are newsletters that I highly value, and read them regularly (daily or weekly).

Medium Priority: these are newsletters and Google Alerts that I will skim daily. There are hundreds of emails per day that go in this category.

Low Priority: these are newsletters that I only occasionally read, and most of the time I’ll go in and just delete them every few days.

My second way of ingesting information is through my Feedly (). I used to use Google Reader, until they closed down that application. I follow 189 blogs through Feedly, and I break these up into several categories:

- Atheism and Apologetics

- Blogging

- Christianity and Theology

- Economics

- Hispanic Political blogs

- Leadership

- Personal friends

- Personal Interest

- Politics

A third major way that I get information is through podcasts. My podcasts roughly follow the same categories as the blogs that I read.

Another major way that I get information is through Twitter. When I first joined Twitter, I thought it would be a huge waste of time, but I’ve come around to see it as a great way to deliver information. I follow (and am followed by) around 28,000 people, so I use Twitter lists to filter whose tweets I see regularly. I also use Hootsuite and Buffer regularly to read tweets and schedule my own tweets to go out.

Side note: for those of you that might think that I spend all of my time on Twitter and Facebook, because you see me post throughout the day, I’m not. I schedule my posts the night before–or early in the morning–so that they go out throughout the day. This way, I’m not stealing from my employers by using the time that I promised that I would give them.

Something of interest to many people that follow me will be that I don’t watch TV news much. For large events (like the presidential inauguration, the State of the Union, or such events) I will watch TV–and typically switch back and forth between Fox and MSNBC–but for the most part I avoid TV news. I do, however, occasionally watch C-SPAN’s Washington Journal (not live, usually several days behind).

On the less timely form of reading, I also read books, both on my and by listening to them on my commute–I have an Audible.com account. I’ll write a post someday on what books I read.

What I Read/Listen To

I know many of you have been saying to yourselves for the past few paragraphs, “But WHAT do you read?” Here’s a list:

High Priority – these are things that I read daily or weekly

Email newsletters:

Best of the Web Today: written by James Taranto of the Wall Street Journal (who has been described as, “so sharp, he sneezes thumbtacks”), a witty and insightful daily post. Long, but well worth the daily time.

RealClearPolitics.com: a daily digest of political editorials from the right and the left, and during election seasons, RCP has a great aggregation of polling data.

Harvard Business Review: a daily email of business and leadership articles.

The Hill daily political digest: The Hill has good political reporting, and also aggregates political news from other news sites.

Michael Hyatt: One of the best leadership and blogging sites out there.

Salon.com Daily Digest: This is a left-leaning site, but I read a LOT of articles on this site. I like to see what the other side is saying ![]()

Blogs:

Atheism: Debunking Christianity, ExChristian.net

Blogging: Copyblogger

Christianity: Desiring God, Justin Taylor, Kevin DeYoung, Stuff Christians Like

Economics: Cafe Hayek, EconLog, The Becker-Posner Blog, Freakonomics, James Pethokoukis

Friends and Family: Living by Lysa, Kacie Mann, Drew Hunter, Chris McGarvey, Above All Things, EFAMILY, and Genuine Chris

Politics: Ann Althouse (center-right), Cato@Liberty (libertarian), FiveThirtyEight (center-left), The Fix (center-left), The Agenda (right)

Podcasts:

48 Days – Dan Miller is a best-selling author that has a podcast that’s on finding your passion, and doing work that is meaningful, purposeful and profitable.

Dave Ramsey – everyone needs to get their financial life in order; Dave Ramsey helps you do that.

Desiring God sermons – to feed the soul.

EconTalk – one of the best economics podcasts out there.

Entrepreneurial Thought Leaders – weekly talks by thought leaders, presented at Stanford.

Grace Church of DuPage sermons – in case you miss a week of Pastor Daryle Worley, you can still get your fix.

HBR IdeaCast – weekly podcast of the Harvard Business Review; short and interesting

Hugh Hewitt – a practicing lawyer, constitutional law professor and author, as well as a radio talk show host, Hewitt has a interview format on his show, and has some of the most interesting interviews.

Manager Tools – if you are a leader or manager, and want to grow in the technical aspects of managing, this podcast is for you.

Medium Priority – these are things I skim, but don’t always read. A medium priority is something that I will skim headlines on, and will read it if it sounds like a good story. For instance, I have a Google Alert (below) on every Illinois congressperson, and I skim the headlines on them to see if they’re doing something interesting.

Email Newsletters:

Reuters Top U.S. News

Seeking Alpha – financial news

New York Post Morning Newsletter

Stratfor Security Briefings – emails about national security

InvestorGuide.com daily summary – stock market daily summary

Commentary Daily

The Patriot Post

Foundation for Economic Education (The Freeman)

Blogs/Podcasts:

Atheism: Sam Harris

Blogging: ProBlogger

Christianity: Blogging Theologically, Challies

Economics: Keith Hennessey, The Big Picture, Carpe Diem, Greg Mankiw

Leadership: Knowledge@Wharton, Seth Godin

Podcasts: C-SPAN Newsmakers, This is Your Life

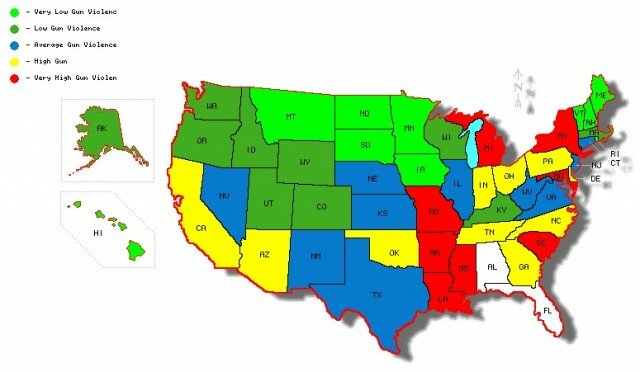

Google Alerts: Aaron Schock, Adam Kinzinger, Alvin Plantinga, Americans for Prosperity, Angus King, atheism, Benghazi, Berkshire Hathaway, Bill Enyart, Bill Foster, Bob Ewoldt, Bobby Rush, Brad Schneider, Bruce Wolf and Dan Proft, Cheri Bustos, concealed carry Illinois, Corey Robin, coup in Nigeria, Dan Lipinski, Danaher, Danny Davis, Darlene Senger, debt crisis, Dennis Hastert, economics, ex-Christian, Flibe Energy, gun control, gun sales, health care rationing, Illinois legislature, Illinois redistricting, “I’m a moderate,” James MacDonald, Jan Schakowsky, Jesse Jackson Jr., John Loftus atheist, John Shimkus, Kelly Ayotte, Luis Gutierrez, Mike Quigley, Naperville, nuclear reactor, ObamaCare, Paul Ryan, Peter Roskam, price controls, Randy Hultgren, reactor design, redistricting reform, Richard Dawkins, Rodney Davis, Roe Conn, Sam Harris, Scott Walker Wisconsin, secular humanism, Stephen Hawking, supply-side economics, Tammy Duckworth, Ted Cruz, term limits, Thomas Sowell, Tim Walberg Michigan, Transatomic Power, trickle-down economics, voter ID law

New/Trial Reading

Here are some things that I’ve recently started reading or listening to, and haven’t decided yet whether I will continue to follow them or not:

Email newsletters:

Morning Buzz from YG by Mark Bednar – a short-ish daily political digest from the Young Guns Network.

– this is a daily political digest from Brad Dayspring, the Communications Director of the National Republican Senatorial Committee.

CitizenLink Team daily email – this is a socially conservative daily email from a subsidiary of Focus on the Family.

The Fiscal Times – a center-left take on fiscal issues.

The American Conservative – “Authentically conservative — modest, open-minded, and uninterested in partisan chicanery,” according to them.

Podcasts:

Steve Deace – on the recommendation of a friend, I’m checking out this conservative talk show host from Iowa.

Commonwealth Club of California – a weekly center-left political forum.

The Christian Worldview – another recommendation from a friend.

Guntalk – given the recent focus on gun control, I’ve started listening to a couple of gun shows.

Cam and Company – another gun show; this is the NRA news daily show.

Tammy Duckworth – 8th Congressional District (Republican to Democrat) – The 8th congressional race was probably the most publicized of the races. Incumbent Rep. Joe Walsh was a controversial Republican member of Congress who was closely associated with the Tea Party. Walsh had originally decided to run in the 14th district, challenging Randy Hultgren for the seat, but later decided to run in the 8th district to avoid a member-on-member primary fight. Duckworth, who had run for Congress in 2006, and had lost to Peter Roskam, had been appointed the director of the Illinois Department of Veterans Affairs, and after President Obama won his first term in 2008, was appointed the Assistant Secretary for Public and Intergovernmental Affairs at the U.S. Department of Veterans Affairs. She also has a list of “firsts” for Congress: first Asian-American elected in Illinois; first disabled woman elected to Congress (she lost her legs when a rocket-propelled grenade hit her helicopter in Iraq in 2004); first member of Congress born in Thailand. She won the race by a convincing 55-45%. She will be 44 years old when she takes office.

Tammy Duckworth – 8th Congressional District (Republican to Democrat) – The 8th congressional race was probably the most publicized of the races. Incumbent Rep. Joe Walsh was a controversial Republican member of Congress who was closely associated with the Tea Party. Walsh had originally decided to run in the 14th district, challenging Randy Hultgren for the seat, but later decided to run in the 8th district to avoid a member-on-member primary fight. Duckworth, who had run for Congress in 2006, and had lost to Peter Roskam, had been appointed the director of the Illinois Department of Veterans Affairs, and after President Obama won his first term in 2008, was appointed the Assistant Secretary for Public and Intergovernmental Affairs at the U.S. Department of Veterans Affairs. She also has a list of “firsts” for Congress: first Asian-American elected in Illinois; first disabled woman elected to Congress (she lost her legs when a rocket-propelled grenade hit her helicopter in Iraq in 2004); first member of Congress born in Thailand. She won the race by a convincing 55-45%. She will be 44 years old when she takes office. Brad Schneider – 10th Congressional District (Republican to Democrat) – Schneider ran in another competitive district. Bob Dold, the incumbent congressman, had defeated Democrat Dan Seals in 2010 to replace Mark Kirk, who won the U.S. Senate race in Illinois that year. The National Journal

Brad Schneider – 10th Congressional District (Republican to Democrat) – Schneider ran in another competitive district. Bob Dold, the incumbent congressman, had defeated Democrat Dan Seals in 2010 to replace Mark Kirk, who won the U.S. Senate race in Illinois that year. The National Journal  Bill Foster – 11th Congressional District (Republican to Democrat) – Foster was in the unique position of running for his old job. He was elected to Congress in 2008 to represent the 14th congressional district after Dennis Hastert resigned from Congress (after losing his speakership). Foster was unseated in 2010 by Randy Hultgren in a hard-fought race. In the 2010 redistricting, Hultgren’s district was made substantially more Republican, so Foster decided to run in the new 11th district, a competitive (but Democratic-leaning) district. He ran against Rep. Judy Biggert, a 7-term incumbent whose district was eliminated in the redistricting. Biggert faltered in the debates, allowing Foster to take the advantage. Foster is a physicist who worked at Fermilab for 22 years, and was on the team of scientists that won the 1989 Bruno Rossi Prize for cosmic ray physics. He won the district 58-42%. He will be 57 years old when he takes office (again).

Bill Foster – 11th Congressional District (Republican to Democrat) – Foster was in the unique position of running for his old job. He was elected to Congress in 2008 to represent the 14th congressional district after Dennis Hastert resigned from Congress (after losing his speakership). Foster was unseated in 2010 by Randy Hultgren in a hard-fought race. In the 2010 redistricting, Hultgren’s district was made substantially more Republican, so Foster decided to run in the new 11th district, a competitive (but Democratic-leaning) district. He ran against Rep. Judy Biggert, a 7-term incumbent whose district was eliminated in the redistricting. Biggert faltered in the debates, allowing Foster to take the advantage. Foster is a physicist who worked at Fermilab for 22 years, and was on the team of scientists that won the 1989 Bruno Rossi Prize for cosmic ray physics. He won the district 58-42%. He will be 57 years old when he takes office (again). Bill Enyart – 12th Congressional District (Democrat to Democrat) – the 12th district in Illinois became a competitive district when representative Jerry Costello (D) decided to retire rather than run for re-election. Enyart did not run in the primary election, but was selected as the Democratic nominee after the primary winner, Brad Harriman, dropped out of the race due to illness. Enyart was selected by a 13-member committee to replace Harriman. He ran against Jason Plummer, who was the 2010 Republican nominee for lieutenant governor. Enyart was a member of the U.S. Air Force before joining the Illinois Army National Guard, and was appointed to lead the National Guard in 2007 by Governor Blagojevich. He has promised to work to fix the flaws with the Affordable Care Act when he gets to Congress. He won 52% of the votes in the race. He will be 63 years old when he takes office.

Bill Enyart – 12th Congressional District (Democrat to Democrat) – the 12th district in Illinois became a competitive district when representative Jerry Costello (D) decided to retire rather than run for re-election. Enyart did not run in the primary election, but was selected as the Democratic nominee after the primary winner, Brad Harriman, dropped out of the race due to illness. Enyart was selected by a 13-member committee to replace Harriman. He ran against Jason Plummer, who was the 2010 Republican nominee for lieutenant governor. Enyart was a member of the U.S. Air Force before joining the Illinois Army National Guard, and was appointed to lead the National Guard in 2007 by Governor Blagojevich. He has promised to work to fix the flaws with the Affordable Care Act when he gets to Congress. He won 52% of the votes in the race. He will be 63 years old when he takes office. Rodney Davis – 13th Congressional District (Republican to Republican) – Davis was one bright light for the Republicans in a day full of sadness. Davis ran to succeed Congressman Tim Johnson, who had held the seat for 12 years. Johnson ran in the primary race, and had a near-certain chance of re-election. But, after he won the primary election, he announced that he would retire from his seat in Congress. Rodney Davis was selected to replace Johnson on the ballot by a 14-member committee made up of Republican County Chairmen. Davis was the campaign manager for Rep. John Shimkus’ first re-election campaign, and then joined the congressman’s staff. Davis won the race by a slim 1,287 votes. He will be 43 years old when he takes office.

Rodney Davis – 13th Congressional District (Republican to Republican) – Davis was one bright light for the Republicans in a day full of sadness. Davis ran to succeed Congressman Tim Johnson, who had held the seat for 12 years. Johnson ran in the primary race, and had a near-certain chance of re-election. But, after he won the primary election, he announced that he would retire from his seat in Congress. Rodney Davis was selected to replace Johnson on the ballot by a 14-member committee made up of Republican County Chairmen. Davis was the campaign manager for Rep. John Shimkus’ first re-election campaign, and then joined the congressman’s staff. Davis won the race by a slim 1,287 votes. He will be 43 years old when he takes office. Cheri Bustos – 17th Congressional District (Republican to Democrat) – A former reporter and editor for the Quad-City Times and former alderman on the city council of East Moline, Cheri Bustos ran in a three-way race to challenge incumbent congressman Bobby Schilling, a pizzeria owner from Moline, Illinois. She defeated Freeport mayor George Gaulrapp and Augustana College executive Greg Aguilar in the primary, and then waged a fierce general election race against Schilling, defeating him 53-47%. From her policy positions, she seems like a run-of-the-mill Democrat: she strongly supports the Affordable Care Act (Obamacare), opposes extending the Bush tax cuts for the top tax brackets, supports the DREAM Act, supports a contraceptive mandate, and opposes free trade acts (calling them in one debate “NAFTA-like”). However, she supports a 10% pay cut for all members of Congress until the federal budget is passed. She will be 51 years old when she takes office.

Cheri Bustos – 17th Congressional District (Republican to Democrat) – A former reporter and editor for the Quad-City Times and former alderman on the city council of East Moline, Cheri Bustos ran in a three-way race to challenge incumbent congressman Bobby Schilling, a pizzeria owner from Moline, Illinois. She defeated Freeport mayor George Gaulrapp and Augustana College executive Greg Aguilar in the primary, and then waged a fierce general election race against Schilling, defeating him 53-47%. From her policy positions, she seems like a run-of-the-mill Democrat: she strongly supports the Affordable Care Act (Obamacare), opposes extending the Bush tax cuts for the top tax brackets, supports the DREAM Act, supports a contraceptive mandate, and opposes free trade acts (calling them in one debate “NAFTA-like”). However, she supports a 10% pay cut for all members of Congress until the federal budget is passed. She will be 51 years old when she takes office.